salt tax repeal march 2021

If the credit exceeds the net tax due the remaining amount may be carried over for five years. As President Joe Biden unveils a multi-trillion-dollar infrastructure proposal this week House Democrats are calling on him to repeal the Trump-era limit on state and local tax deductions or SALT.

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

Three House Democrats say they wont support any of President Joe Bidens tax hikes to fund his infrastructure proposal unless the plan includes a repeal of the 10000 cap on state and local.

. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031. Pelosis office has reportedly suggested that this would be. 1 but no later than March 15 of the tax yearie by March 15 2022 for the 2022 tax year.

More from Personal Finance. New Yorks SALT Workaround. October 05 2021.

Retroactive SALT Repeal Combines Weak Stimulus with Bad Tax Policy. Nov 19 2021. The elective tax does not have an expiration date concurrent with the sunset of the federal SALT cap.

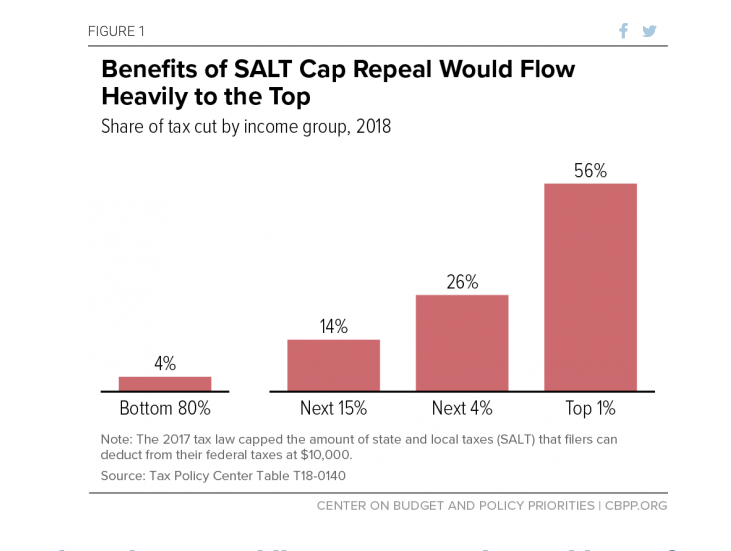

Other taxpayers in the top 5 percent of filersthose with incomes between 165181 and 401600would see their after-tax incomes rise by 09 percent with a SALT cap repeal meaning they would. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household.

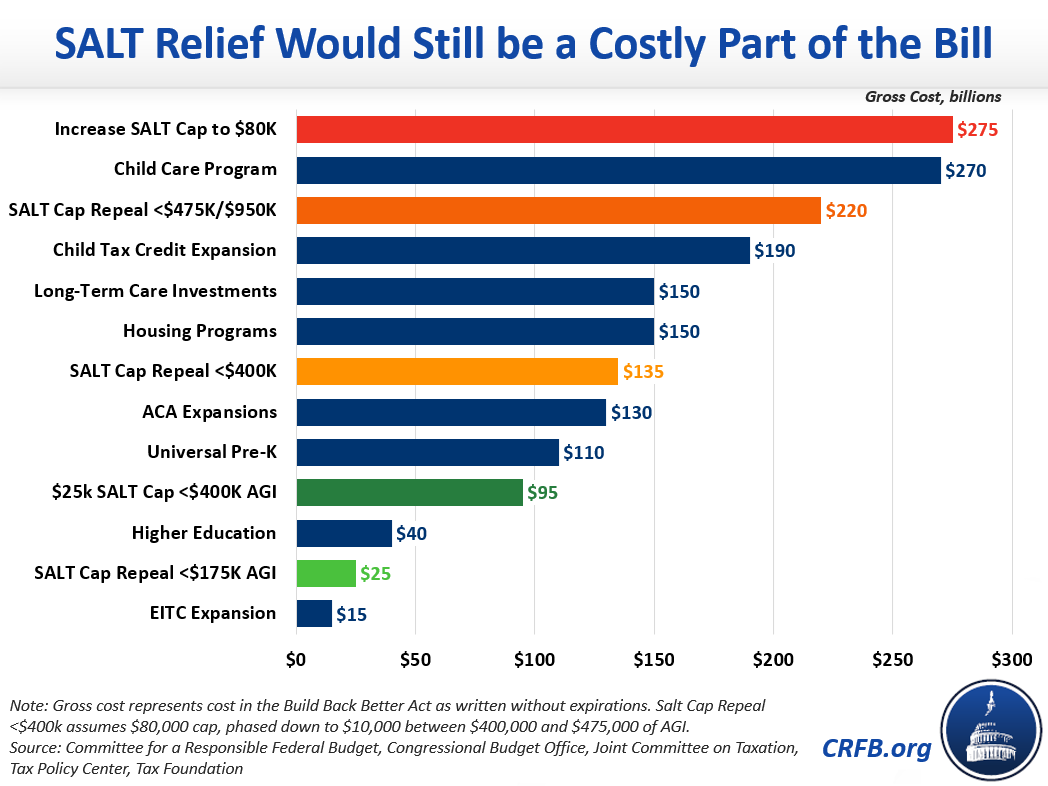

Americans who rely on the state and local tax SALT deduction at. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. Estimates that repealing the SALT tax deduction would cost the federal government 380 billion.

Most people do not qualify to itemize after the 2017 tax reform. Dec 11 2021. If the 10000 federal SALT cap is not repealed in the intervening years the election is effective for taxable years beginning on or after January 1 2021 and before January 1 2026.

By Clark Kauffman March 26 2021. California Passes SALT Cap Work-Around. Manchin told CNN that the Build Back Better bill is dead.

Restoring the full SALT deduction would cost the US. Congresss Joint Committee on Taxation says full repeal would cost the Treasury 89 billion in foregone revenue per year. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Treasury 887 billion in lost revenue for 2021 alone according to the Joint Committee on. No SALT no deal they said. The Democratic outline for the reconciliation bill says only that it will include SALT cap relief That probably wont be a full repeal which would be expensive.

On Tuesday Mr. Mar 25 2021 959pm Updated on Mar 25 2021 By. July 29 2021.

March 30 2021. With only a 3 vote Democratic Majority in the House Suozzi will work to have other Members join his pledge. March 1 2022 600 AM 5 min read.

That should spell the end for the SALT deduction a benefit for. Today Congressman Tom Suozzi D-Long Island Queens issued the following statement. House Democrats pass package with 80000 SALT cap till 2030 Here are must-know changes for the 2021 tax season How to pay 0 capital gains taxes with a six-figure income.

The period to opt-in to the New York PTET has ended for tax year 2021 but for tax years 2022 and later an eligible entity may opt in on or after Jan. Sanders initially balked at including a repeal of the SALT deduction cap in reconciliation but his stance seems to have softened. Repeal of the SALT deduction cap would give those in the bottom half of income distribution a tax cut of on average at most 1 but an average tax.

A new bill seeks to repeal the 10000 cap on state and local tax deductions. For taxable years beginning on or after January 1 2021 and. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year.

Such a plan would be still be very costly and regressive delivering the largest tax cut to very high-income households. House Speaker Nancy Pelosi D-CA has suggested that a retroactive repeal of the cap on State and Local Tax SALT deductions should be included in any future stimulus plans. As negotiations continue on a bipartisan infrastructure agreement certain members of Congress from high-tax states are desperate to tack on a repeal of the 10000 cap on the state and local tax SAL.

While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its. News 12 Staff A number of local Congress members were at the home of a White Plains homeowner Thursday to call for a repeal of the 10000 cap on. No SALT no deal.

According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less.

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

State And Local Tax Salt Deduction Salt Deduction Taxedu

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Eight Democrats Vow To Oppose Tax Bill Without Salt Restoration As White House Balks

What Is Salt Tax Deduction Mansion Global

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans